| News Archive |

| Google testing car that drives itself |

|

| Business & Finance Club - New York : Google Inc, the world's largest Internet search engine, has been tinkering with engines of another sort and come up with some futuristic results -- a car that drives itself.

|

|

|

|

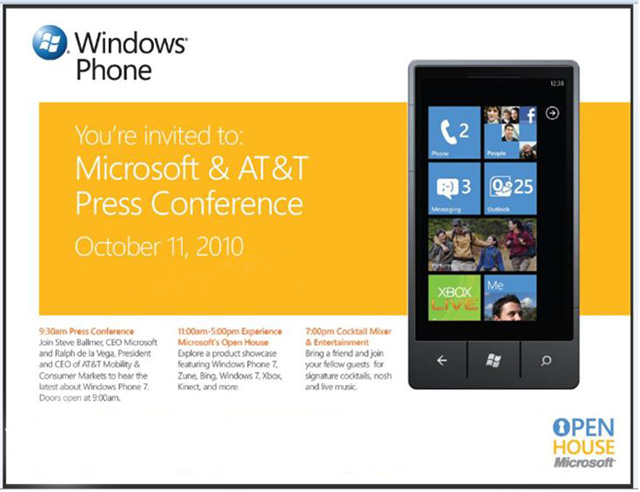

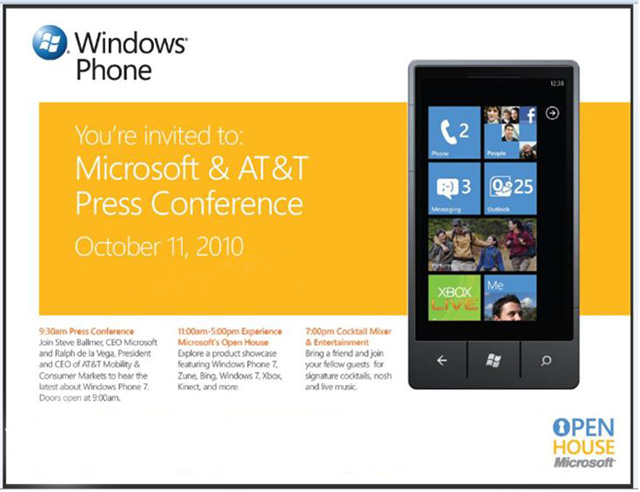

| Microsoft to Launch Windows Phone 7 Today |

|

| Business & Finance Club - U.S : Initially released ten years ago, in April 2000, Microsoft’s mobile operating system – Windows Mobile – was once a |

|

|

|

| Bangladesh in exploration deal with ConocoPhillips |

|

| Business & Finance Club - Dhaka: State-run Bangladesh Oil, Gas and Mineral Corporation clinched a preliminary deal with US firm ConocoPhillips yesterday |

|

|

|

| Boeing keen to take Gulf ties to a different plane |

|

| Business & Finance Club - Dubai: Boeing's relationship with the Middle East goes back more than 60 years. Investment in that relationship is paying off as the region is now one of the world's fastest-growing commercial aircraft markets.

|

|

|

|

| Trade thrives along the new Silk Route |

|

| Business & Finance Club - Dubai: The UAE and China are likely to strengthen their trade relationship in the coming years further, a recent study by the Dubai Chamber of Commerce and Industry has revealed.

|

|

|

|

|

|

| MENA Powering up – Energy demand to double by 2030 |

|

Business & Finance Club Magazine - Stations - The demand for power in the MENA region is huge and expected to double by 2030. Yet, financing remains a problem.

The Middle East’s thirst for power is insatiable. Summer demand constantly outstrips capacity in many Peninsula states, leading to regular brownouts and a run on small to medium-sized generators to ensure uninterrupted supplies.

Demand fuelled by high birth rates has been rising at a steady 6-8 per cent a year for several decades now and though the growth rate has dipped in the past year in response to the world slump – especially in Dubai where the beleaguered construction sector is traditionally a big consumer – it is likely to be only a temporary blip.

The latest projections indicate that demand in the Middle East and North Africa (MENA) region will double by 2020, necessitating the installation of at least another 250GW of new capacity.

The generating profile of the MENA countries divides into the energy rich, sparsely populated desert states that use dirt-cheap oil and gas as feedstock for power-generation, while the populous states with limited energy resources, relative to their population size, tend to have a more varied mix of power generation. That said, more than 95 per cent of all power produced in the region is thermally generated.

The ‘oil states’ consume, on average, ten times more electricity per capita than the region’s poorer, populous states – and there is little evidence of the gap narrowing. This is because these states provide their citizens with cheap, subsidised electricity and have to contend with the huge power demands of providing desalinated water.

The poorer states have had a natural tendency to subsidise electricity, restricted by the straightjacket of Structural Adjustment Programmes. In the case of Egypt, the resulting structural reduction in demand in the mid-1990s led to a significant, and permanent, lowering of consumption patterns and, consequently, the country’s future capacity requirement.

Under-investment in reserve capacity has meant the Gulf Cooperation Council (GCC) states, which make up roughly a third of the MENA market, have been running to a standstill to keep up with demand. It has been a Sisyphean task. Some 55GW of new capacity is planned by 2015, boosting the current 75GW capacity by 80 per cent and desalinated water production is to double to more than 5 billion gallons a day.

One solution to dealing with peak load spikes – the cause of the outages – has been to build easy-to-install gas-turbine generation, rather than more economical but more expensive options, such as steam or combined-cycle power generation.

However, installing ever-more capacity is not a solution. Flattening the peak load curve through ‘smart’ pricing – charging more for peak consumption – or offering incentives for off-peak consumption can greatly ease pressures on capacity. However, the GCC states have been reluctant to cede control of electricity pricing, which is viewed as a political prerogative, and have looked at other ways to make savings.

Saudi Arabia has decided to skirt the subsidy issue by focusing on improving capacity utilisation and streamlining the delivery of power. The industry has undergone a number of reorganisations in the past 15 years, the latest of which will see the Saudi Electricity Company reconfigured as a holding company for four competing generating companies, with the Kingdom’s power plants divided between them, and separate transmission and distribution companies. The introduction of a national grid has helped to spread power loads, as will the full commissioning of a GCC grid in July 2011.

However, the benefits are limited compared with the load-sharing that would result from exploiting time zone differentials between Egypt and the GCC grid. An interconnector between Egypt and Saudi Arabia is planned and has been put out to tender. The advantages of a region-wide grid have to be weighed against steep power transmission costs – though these are coming down with technological advances.

The Kingdom has a deep enough pocket to ‘go it alone’ and though it has reluctantly agreed to provide guarantees for a handful of independent power producers, the bulk of the $120 billion it will be spending on installing 35GW of new capacity by 2023-25 – effectively doubling current capacity – will be let on a turnkey basis. Other GCC members, such as the UAE and Oman, have successfully ‘commercialised’ the income stream necessary to attract private investment in Build-Own-Operate (BOO) schemes.

Turkey has gone furthest down the road to establishing a market-driven electricity industry. With a relatively developed industrial base, large population but limited energy and financial resources – it pioneered the BOO financing model – it does not fit the standard profile. It has, with Iran, by far the largest proportion of hydro in its power mix. Hydro accounts for around 25 per cent of total production (and currently engages only a third of its potential capacity) with coal and lignite accounting for another 25 per cent.

Most of Turkey’s remaining power is generated from imported oil and (predominantly) gas. It will need to double its current 40GW capacity by 2020 (including 4GW of nuclear power), to accommodate a doubling of per capita consumption – and find an estimated $130 billion to finance it.

With roughly the same population, Egypt generates barely 65 per cent of the power and is on a lower demand curve with annual growth projected at 4 per cent against Turkey’s 6 per cent. It is trying to reduce its dependence on thermal generation, which is just below the region’s average, and promote nuclear, hydro and renewables.

Egypt has used BOO-style financing schemes for thermal power stations and alternative energy projects, but it is still struggling to eliminate subsidies. It is planning to increase hydro production, now 5 per cent of the total, by more than 20 per cent in the next five years, by improving the operational capacity of the High Dam and introducing more barrages on the Nile.

Hydrogeneration has not been an unalloyed success in the MENA region; unreliable rainfall has forced Algeria to downsize its hydro plans and Morocco to abandon them completely.

Oil states that emulated the UK’s ‘dash for gas’ are ruing the day, as they also run out of gas feedstock. Saudi Arabia, Kuwait and the UAE face having to convert power stations back to fuel oil or diesel because of the lack of gas.

It highlights a key point in all power-generation planning in the MENA region: security of primary energy supplies. It is an important factor behind the push into renewable energy and nuclear power. Net energy importers, such as Turkey and Morocco, are keen to exploit their ‘assets’ – 1 billion tonnes of lignite deposits and a massive 12.3 billion tonnes of oil shale reserves, respectively. Morocco has already built a pilot 100MW power plant fired by oil shale.

However, the most effective ways to overcome shortages are conservation – taking the path to lower consumption already adopted by Egypt – and evening out consumption peaks. These measures would do more than anything to relieve the region’s chronic lack of capacity. |

|

|

|

| |

|