Business & Finance Group - Real Estate - Kuwait: Up to the end of 2007, the Real Estate and Construction sectors in Kuwait had a buoyant market fuelled by the rising oil prices. Improved surpluses in public finances along with abundant liquidity among local banks poured vast sums of money into new projects, specifically retail, office and residential projects.

In terms of contribution to GDP, total real estate and construction activities grew from KD 847 mn during 1998 to KD 1.3 bn during 2003 and KD 1.75 bn during 2008 representing an average contribution of 7.3 percent over the period 1998-2008 and growing at a CAGR of 7.53 percent over the same period. Since the start of the economic crisis in 2008, activities of both sectors have been on a downward trend with a large number of major projects either delayed or cancelled, recording a decline of 4.5 percent in 2008 as reported by the CBK.

This dry up in market activity has brought liquidity levels to an all time low, thus, forcing government intervention by injecting money into the banking system, issuing guarantees for private sector deposits and reducing the CBK discount rate from 5.75 percent in the beginning of 2008 to 2.5 percent during Feb-10. As a result, these measures have helped in the short-term stability of the market by providing sufficient liquidity in order to avoid a halt and sustain market activity.

According to information published by the Ministry of Justice, the average monthly value of registered real estate transactions in 2009 decreased by around 7 percent since 2008 from KD 304 mn to KD 284 mn. Kuwait posted over KD 73 bn in oil revenues over the past five years, its budget surplus amounted to over KD 26.8 bn over the same period before accounting for reserves for future generations.

In terms of market capitalization, the real estate sector in Kuwait has witnessed a significant drop from its record high of KD 5.41 bn in June of 2008 to about KD 1.97 bn as of April-10, representing a staggering 64 percent drop over the period. This drop in market cap has brought the real estate sector size back to its 2004 levels. With this market cap level, the real estate sector represents about 5.8 percent of the Kuwait Stock Exchange, indicating a highly fragmented sector dominated by small to medium sized companies.

Segmentation Analysis

Comprising of 3 major segments; Residential, Investment and Commercial Properties; the Real Estate Sector total monthly sales saw a greater decline in 2009 than seen during 2H-08, the starting stages of the crisis. Up to the end of 2009, sales averaged around KD 107 mn per month compared to a 2008 average of KD 156 mn, representing a drop of 31.4 percent. Average number of deals witnessed a drop as well of 25.6 percent from 514 transactions per month in 2008 to around 382 in 2009.

Apart from the financial crisis, the enactment of Laws No. 8 and 9 of 2008, which prevent shareholding companies and establishments from doing business in the residential segment while simultaneously placing specifications for the disposition of assets in those segments, had a negative impact on the real estate market through low liquidity levels and diminishing demand, which in turn put further pressure on real estate prices.

Residential Segment

The Residential Segment of the Kuwaiti real estate market primarily consists of properties under the government housing program known as, the Public Authority for Housing Welfare (PAHW), thereby, making the Residential segment the largest and the most important in this sector.

Growth in residential properties is positively correlated to the growth of the Kuwaiti population, as the government program is only offered to Kuwaiti nationals, but over the last 30 years, the rate of growth in this segment has far exceeded that of the population. Yet, the residential market is still considered to be under supplied. Unmet demand in this segment has spurred the government to work with real estate companies on developing new residential areas such as Saad Al Abdullah area in South Jahra, Dahiyat Abdullah Al Mubarak in West Jaleeb Al-Shouyukh, South Surra and Abu Futaira.

Applications for housing have seen a compounded annual growth rate (CAGR) of 18.3 percent between 1985 and 2009. However, this growth has slowed down to an average of 4.7 percent since 2000 primarily due to a drop in applications over the last three years. This drop in applications can be attributed to the over priced housing during 2007 and 2008 in conjunction with the long time frame taken to process eligible Kuwaiti citizen’s housing applications and approving them, which in some cases may reach up to 15 years and the introduction of the CBK cap on residential loans.

Investment Segment

This segment encompasses the construction of residential apartments, villas and land purchases for trading and investment purposes. The residential apartments are primarily occupied by the expatriate population, which has been increasingly growing between 2003 and 2009 at a CAGR of 6.53 percent, a growth rate that’s exceptionally high compared to the Kuwaiti population CAGR of 3.2 percent over the same period. Apart from the current crisis, recent researches estimate the expatriate population to grow at a higher pace in the long term due to expected expansion in Kuwait’s economy over the next 15-20 years.

Properties under the investment segment have higher return expectations due to higher residential land valuations, along with the potential for rental growth and the restrictions on foreign ownership.

During the first nine months of 2009, apartment rental rates were considered marginally lower compared to a year before, with an average rental rate around KD 182 for a 1-bedroom apartment, KD 214 for 2-bedrooms and KD 302 for a 3-bedroom apartment, and average residential land rates remaining almost constant according to the quarterly research from Kuwait Finance House. However, with the current real estate market and tough economic conditions, rental rates are expected to decline during 2010 given the declines witnessed in rates throughout 2009.

Commercial Segment

Encompassed in this segment are complexes and retail establishments as well as the sale or rental of spaces in commercial buildings. Recently, there has been a new focus in this segment to target an increasing number of tourists every year through new hotels, shops and resorts. Growth in this segment started at a later stage compared to the other real estate segments due to the shortage of investors and the large capital expenditures required for each commercial project. During the last few years, however, this segment witnessed an increase in institutional investment in the construction of such projects in response to the economic boom present during the period along with the ease of access to the credit market.

Kuwait currently offers around 5,000 rooms in 20 properties represented by the major international hotel chains. By 2011, the number of rooms is expected to double, with 2,300 due to come online in 2009 alone, according to annual research by NAI Global. Due to the current market situations, vacancy rates are increasing and expected to follow an upward trend during 2010 as many tenants decide not to renew contracts or negotiate lower rates. On the corporate scale, large company layoffs reduced the space companies need to house employees, leading to higher vacancy rates not to mention the large supply from newly developed properties that is supposed to enter the market in the near future with the completion of some large real estate projects.

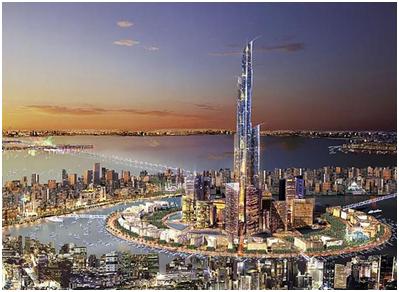

Over the past few years, increased interest in the GCC real estate market, including Kuwait, has led to an impressive build up in the region’s retail real estate market. According to research by Retail International, about 9.5 mn square meters of mall gross leasable area (GLA) has been added in 2008 compared to 7.75 mn square meters during 2007. Mega commercial projects that are currently under construction include United Tower, Symphony Mall, Kuwait Business Town, and the Al-Hamra tower which is going to be the tallest tower in Kuwait and the first ‘sculptured’ building in the world. |